Market Overview:

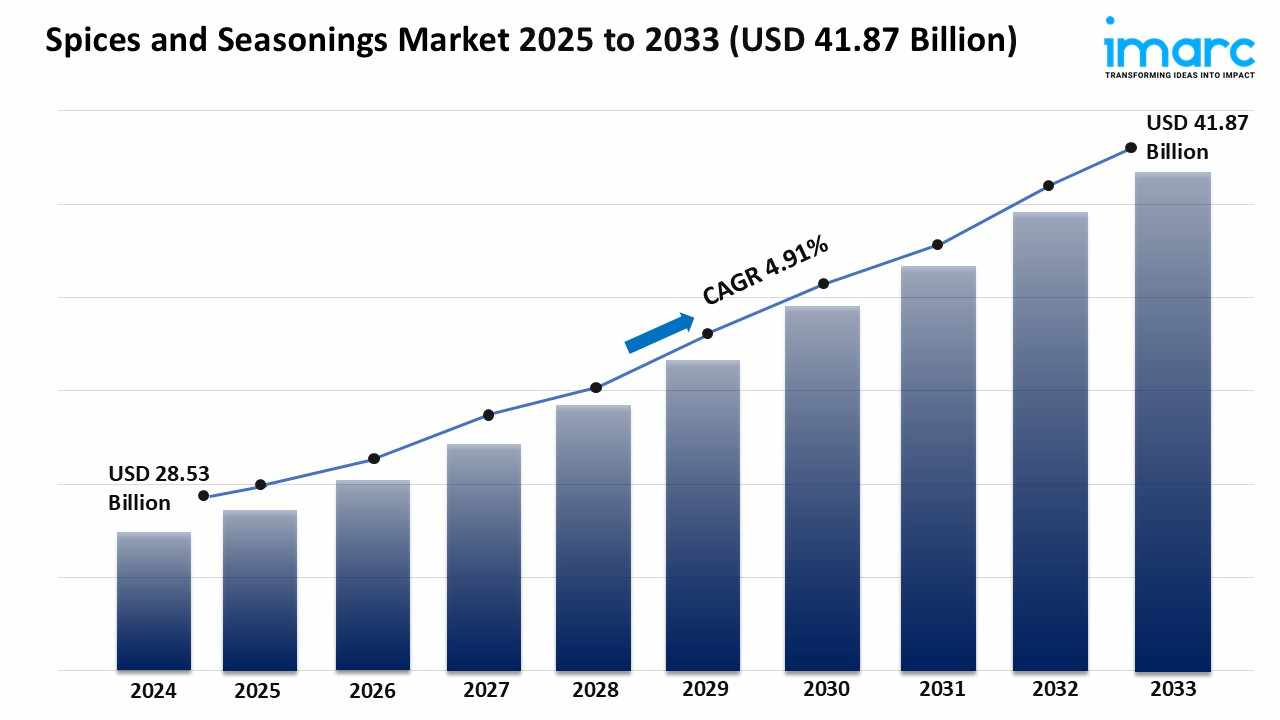

The spices and seasonings market are experiencing rapid growth, driven by rising demand for ethnic and exotic flavors, health-conscious consumer preferences, and growth in home cooking and convenience. According to IMARC Group's latest research publication, "Spices and Seasonings Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033, the global spices and seasonings market size was valued at USD 28.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.87 Billion by 2033, exhibiting a CAGR of 4.91% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/spices-seasonings-market/requestsample

Our report includes:

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Spices and Seasonings Market

Rising Demand for Ethnic and Exotic Flavors

People worldwide are craving bold, diverse tastes, driving the spices and seasonings industry's growth. As globalization connects cultures, consumers are eager to explore authentic flavors from regions like Asia, Latin America, and the Middle East. India’s spice exports reached $4.46 billion recently, showing a 17% jump from the previous year, driven by demand for spices like turmeric and cumin. Restaurants and home cooks are experimenting with global cuisines, boosting sales of spice blends like harissa or garam masala. Companies like McCormick & Co. have seen increased sales of ethnic seasoning mixes, reflecting this shift. Social media platforms, like Instagram, amplify this trend, with food influencers showcasing vibrant, spice-heavy dishes, inspiring consumers to recreate these flavors at home.

Health-Conscious Consumer Preferences

Health awareness is fueling the industry as consumers seek natural, functional ingredients. Spices like ginger and cinnamon are popular for their anti-inflammatory and antioxidant properties, driving demand in wellness-focused markets. Turmeric sales have surged due to its link to immune health, with brands like Simply Organic reporting double-digit growth in organic spice lines. Government initiatives, like India’s Paramparagat Krishi Vikas Yojana, support this by encouraging sustainable spice production. Consumers are also choosing low-sodium seasoning blends to reduce salt intake, especially in North America, where 97,000 foodservice outlets drive demand for healthier options. This shift toward clean-label, natural products is pushing companies to innovate with organic and non-GMO certifications to meet consumer expectations.

Growth in Home Cooking and Convenience

The rise in home cooking, especially post-pandemic, has boosted the spices and seasonings market. With more people preparing meals at home, there’s a growing need for easy-to-use seasoning blends that simplify complex recipes. The seasoning blends market, valued at $7.77 billion recently, is thriving due to this trend. Brands like Badia Spices have launched pre-mixed blends for tacos and curries, catering to busy home cooks. Retail sales of spices have spiked as grocery chains like Walmart report increased purchases of spice racks and single-serve packets. Government support, such as the U.S. Department of Agriculture’s funding for local food systems, boosts small-scale spice producers, making diverse, high-quality products more accessible to consumers.

Key Trends in the Spices and Seasonings Market

Organic and Sustainable Sourcing

Consumers are leaning into organic and sustainably sourced spices, reflecting a shift toward eco-conscious eating. Shoppers prioritize transparency, wanting to know where their spices come from. Burlap & Barrel, a spice company, partners with small farmers in Tanzania for single-origin black pepper, seeing a 30% sales increase last year. India’s organic spice exports have grown, supported by government schemes like the National Programme for Organic Production, ensuring traceability. This trend is evident in Europe, where retailers like Tesco stock certified organic spice lines. Sustainability appeals to younger buyers, with 60% of millennials willing to pay more for ethically sourced products, pushing companies to adopt fair-trade practices and eco-friendly packaging.

Premium and Artisanal Spice Blends

The market is buzzing with premium and artisanal spice blends as consumers seek unique, high-quality flavor experiences. Brands like The Spice House are rolling out small-batch blends, like smoked paprika mixes, which saw a 25% sales boost online. Chefs and home cooks are drawn to these curated products for their authenticity and complexity. In North America, the foodservice industry, with 97,000 restaurants, drives demand for premium seasonings to elevate dishes. Companies are tapping into regional flavors, like za’atar from the Middle East, which has spiked in popularity on menus. This trend is amplified by social media, where viral recipes featuring artisanal blends inspire purchases, blending culinary art with convenience for flavor enthusiasts.

Plant-Based and Clean-Label Innovation

The plant-based movement is reshaping the spices and seasonings market, with clean-label products taking center stage. Consumers want natural, additive-free seasonings to complement vegan and vegetarian diets. Olam International reports growing demand for black pepper in plant-based recipes, especially in meat alternatives. Sales of clean-label spices have risen, with 70% of U.S. consumers preferring products without artificial ingredients. Companies like Frontier Co-op are launching spice blends free of MSG and preservatives, aligning with this trend. In India, government support through the Spices Board’s quality certification programs ensures clean-label standards for global markets. This focus on natural ingredients is transforming product lines, making spices a key player in the plant-based food revolution.

Leading Companies Operating in the Global Spices and Seasonings Industry:

Ajinomoto Co. Inc.

ARIAKE JAPAN Co. Ltd.

Associated British Foods plc

Baria Pepper Co. Ltd.

Döhler GmbH

DS Group

EVEREST Food Products Pvt. Ltd.

The Kraft Heinz Company

Kerry Group plc

McCormick & Company

Olam International

Sensient Technologies Corporation

SHS Group

Spice Hunter (Sauer Brands Inc.)

Unilever plc

Worlée-Chemie GmbH

Spices and Seasonings Market Report Segmentation:

By Product:

Salt and Salt Substitutes

Herbs

Thyme

Basil

Oregano

Parsley

Others

Spices

Pepper

Cardamom

Cinnamon

Clove

Nutmeg

Others

Spices represent the largest segment due to their widespread use across various cuisines across the globe.

By Application:

Meat & Poultry Products

Snacks & Convenience Food

Soups, Sauces and Dressings

Bakery & Confectionery

Frozen Products

Beverages

Others

Meat and poultry products account for the majority of the market share as people use a variety of spices and seasonings to customize the taste of their meat and poultry according to personal preferences and cultural influences.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Asia Pacific dominates the market on account of the rich culinary traditions and the incorporation of spices and seasonings in traditional cuisines.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Write a comment ...